The 2025 ACA Season Has Arrived – Prepare with These Helpful Tips

Employee Navigator helped file more than 3 million ACA forms last year. Start 2025 off right with a simpler way to handle ACA reporting and filing. With Employee Navigator, you can manage benefits and ACA reporting in one place using our easy-to-navigate dashboard, modern tools, and seamless partnership with Nelco.

ACA season doesn’t have to be stressful – we’re here to make it easier. Check out our roundup of best practices and common mistakes to help you confidently navigate the reporting and filing process.

Best Practices for a Smooth ACA Reporting Season

Keep Your Data Updated Year Round

It’s easy to fall into the trap of waiting until ACA season to update employee data, but you can save yourself the stress of tight deadlines by keeping records updated throughout the year. Specifically, ensure the employees classified as Variable Hour are consistently updated with their hours. We recommend taking some time once a month to upload hours for Variable Hour employees and utilize the Eligibility Dashboard to manage the employees.

Take a Little Extra Time to Audit

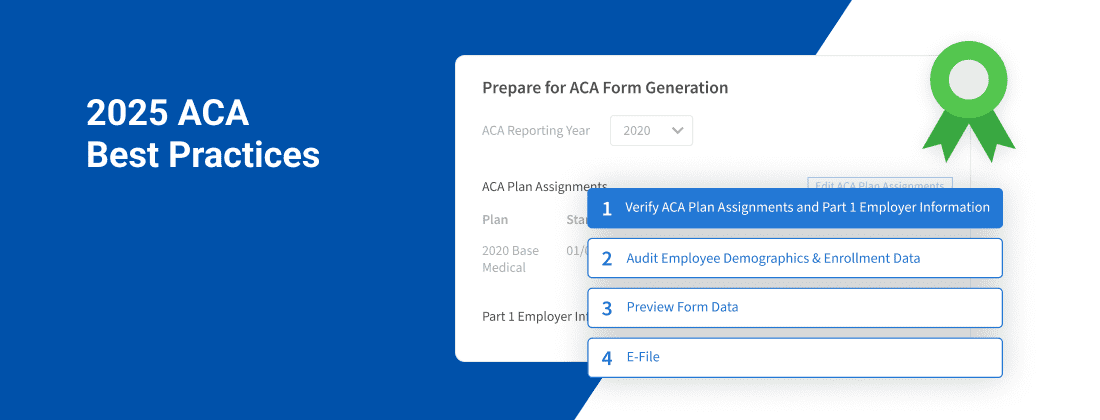

The last thing anyone wants is a hefty fine caused by an avoidable mistake. Human errors can happen, but reviewing and correcting those errors before submitting forms to the IRS can save you time and money. Employee Navigator’s four-step audit process can help you ensure the data is accurate for an error-free ACA filing.

Get a Head Start on Filing

Don’t wait to file for ACA this year. Forms 1094 and 1095-C must be filed by March 2, 2026, if mailed to the IRS or by March 31, 2026, if you are filing electronically. As the deadline approaches, there is less time to resolve any issues, and no one wants to encounter a mistake in the final hours before the filing deadline. Give yourself extra time to input any missing data, generate forms for each employee, audit the information, and send everything to Nelco to file with the IRS.

Common Mistakes to Avoid

Answer Every Question Accurately

Don’t forget about Part One Employer Information questions. It’s a common mistake to skip over these crucial questions, or even answer them inaccurately, which can impact the forms significantly. The answers to these questions guide both the type of forms generated and the way they are completed for the company. We recommend keeping an eye open for these questions and double-check that every question is complete.

Check Off the Self-Funded Box

Confirm the settings for self-funded plans. Employee Navigator uses both plan settings and the Employer Information responses in Part One to determine whether B-series or C-series ACA forms are generated. If a self-funded plan is not marked as self-funded in the system, B series forms can mistakenly be generated instead of the required C series forms. Using the wrong forms can lead to extra time and money spent on additional filing and manual edits in Nelco. Before the forms are generated, if there is a self-funded plan, take a quick look to ensure it is marked correctly in the system.

Don’t Procrastinate

Spare some time to review the ACA forms sooner rather than later. Even small mistakes can take time to review, confirm, and update. Identifying a mistake in January rather than near the deadline can mean the difference between a smooth ACA filing and a stressful, late submission. If there are no mistakes to catch early, you have one less thing glaring at you on your to-do list.

A Stress-Free ACA is in Reach

As you dive deeper into ACA reporting, consider the best practices and the avoidable common mistakes to save yourself from a future headache. Employee Navigator’s ACA reporting tool helps make the first quarter of the year smooth and hassle-free. Learn more about ACA reporting through Employee Navigator and our transparent pricing for a smooth ACA experience this year.